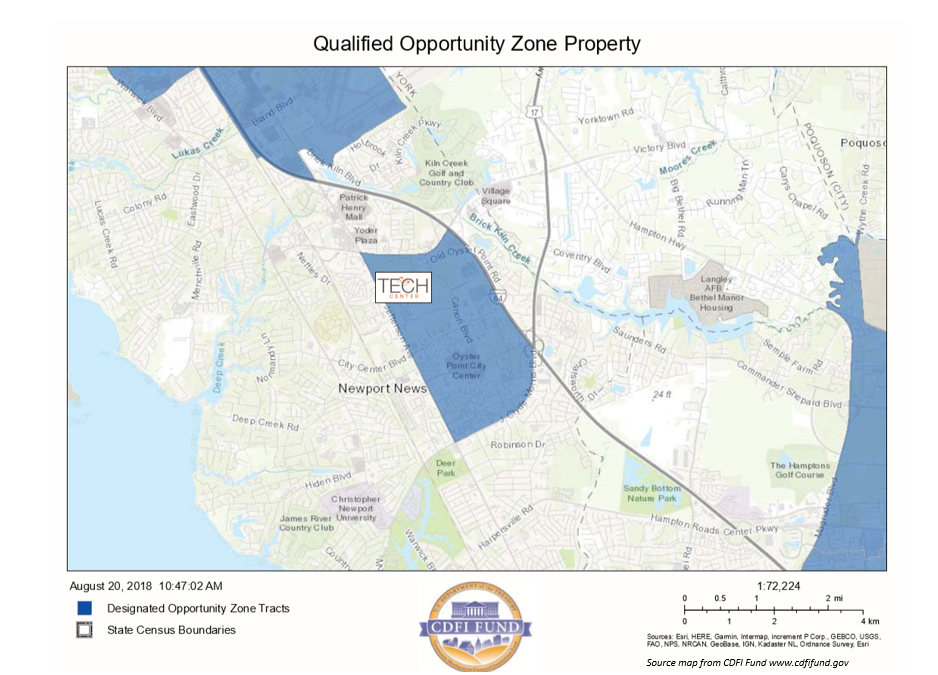

TECH CENTER RESEARCH PARK IS AN OPPORTUNITY ZONE!

Tech Center Building One!

May 11, 2018

Tenants Move In!

June 7, 2019

Accounting Today published a recent article regarding tax incentives available to Qualified Opportunity Zone Businesses.

“The Federal Tax Cuts and Jobs Act of 2017 includes provisions for a new revitalization tool, the Opportunity Zone, and Opportunity Fund. Broadly speaking, the Zones and Funds will allow investors to receive tax benefits on currently unrealized capital gains by investing those gains in qualified census tracts (Opportunity Zones).”

More information on Opportunity Zones Resources can be found on the CDFI Fund website.

We advise that you contact a CPA or attorney about this tax benefit.